forums

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Off-Topic Stock Market & Crypto Discussion

- Thread starter Bird4um

- Start date

Advertisement

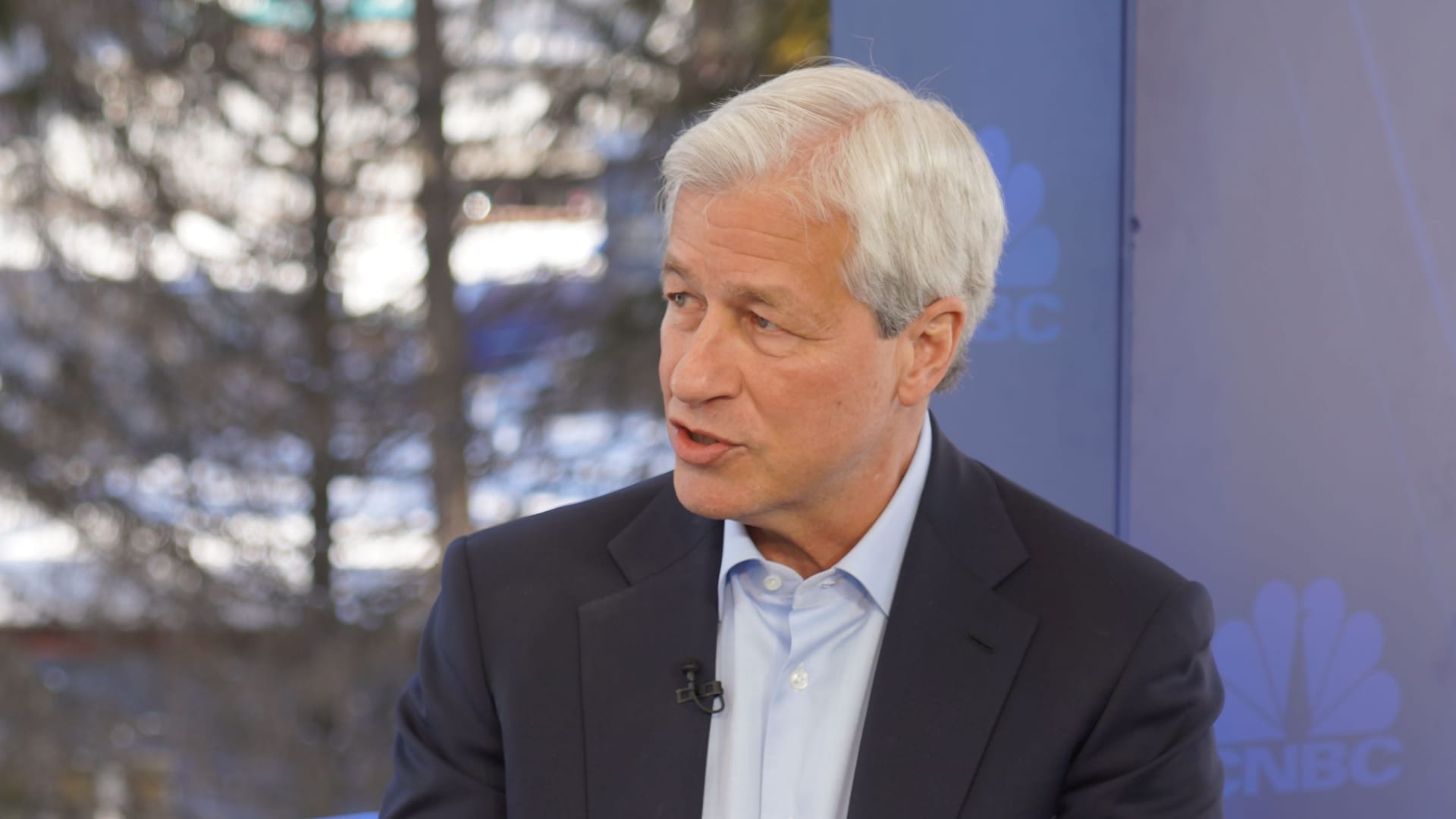

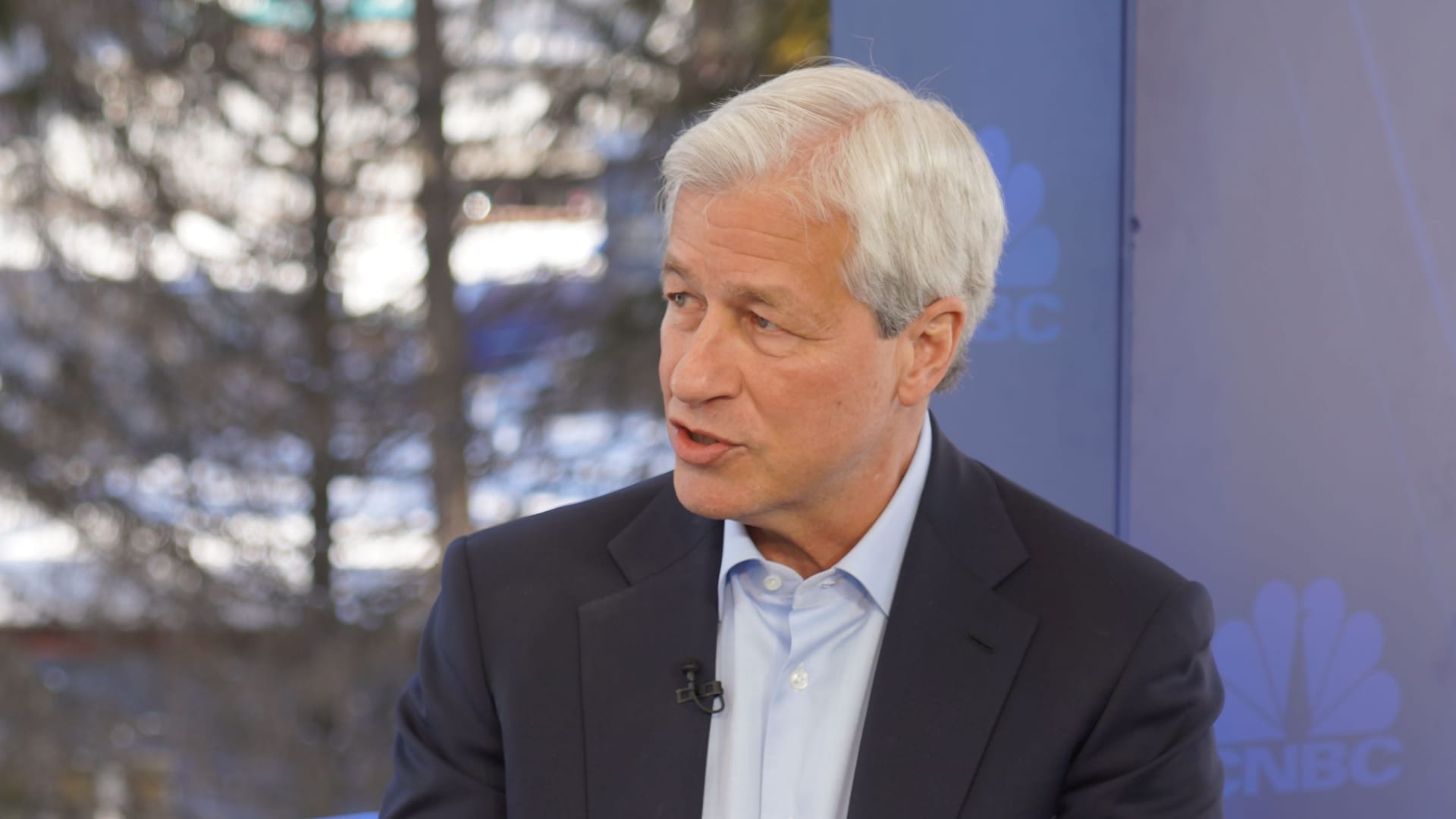

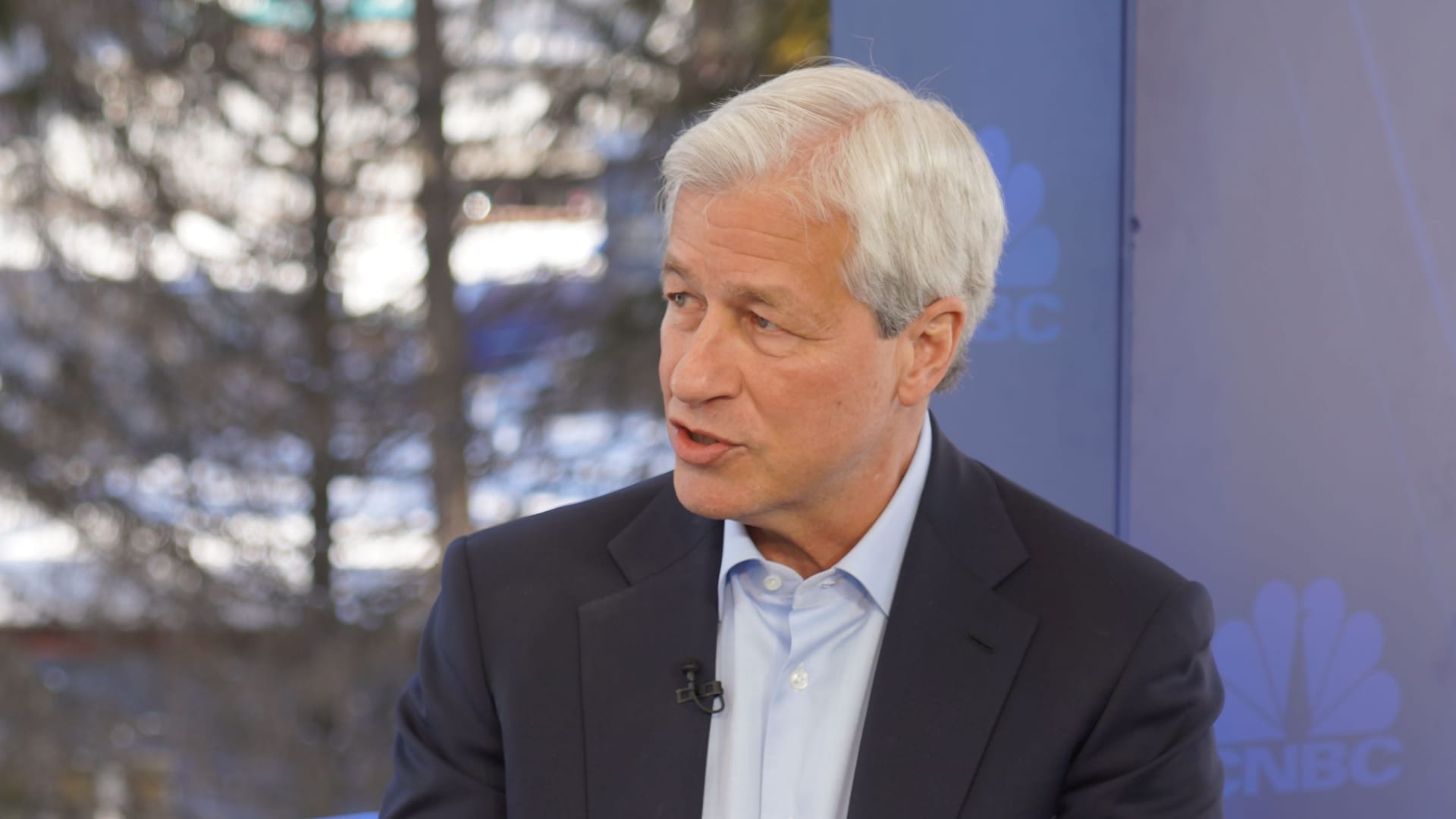

And if you dont believe David, how about Jaime Dimon?

www.cnbc.com

www.cnbc.com

Jamie Dimon says 'brace yourself' for an economic hurricane caused by the Fed and Ukraine war

"You know, I said there's storm clouds but I'm going to change it … it's a hurricane," Dimon said Wednesday at a financial conference in New York.

- Joined

- Nov 28, 2016

- Messages

- 8,734

Btw, my buddy emailed the president Don @ DME to ask if the plant would be finished in june and the answer was "give or take a couple weeks"Just a matter of time boys.

DESERT MOUNTAIN ENERGY APPOINTS MARTA HODAN WASKO AS VICE PRESIDENT OF GEOLOGY, by @newswire

TSX.V: DMEU.S. OTC: DMEHFFrankfurt: QM01ceo.ca

VANCOUVER, BC, June 1, 2022 /CNW/ - DESERT MOUNTAIN ENERGY CORP. (the "Company") (TSXV: DME) (OTC: DMEHF) (Frankfurt: QM01) From the President of the Company

The Company is pleased to announce that it has added Marta Hodan Wasko as VP of Geology. Marta is a petroleum geologist with a focus on sedimentology and stratigraphy with multiple years of experience in exploration, development, reservoir characterization, and wastewater injection. She has multiple degrees from the Colorado School of Mines, coupled with her experiences, in both the private sector and state regulation. Marta also has experience in well planning, permitting and drilling for oil, gas, helium and wastewater while working in both the private sector and state regulation. Her most recent position was as the Program Administrator for the Arizona Oil and Gas Conservation Commission. She worked on state regulations for oil, gas, and helium development while gaining knowledge of the historic and current helium exploration and development, in addition to gaining experience working with federal, state, local and Indigenous jurisdictions.

"We are extremely pleased we were able to have Marta join our company," says Robert Rohlfing, CEO of Desert Mountain Energy Corp. "She has an outstanding track record within the industry and her overall knowledge of both geology and regulatory compliance aspects are a great fit for our continued growth."

GENERAL UPDATE

- Construction on the McCauley Helium Processing Facility continues and DME will be adding selected pictures of the assembly to the website as it approaches completion. The Company expects to drill the next wildcat in the early part of July after the rig is released from the project it is currently on. DME will announce the permits when they have been received.

- Desert Mountain Energy's trucking company has sufficient work committed to keeping the equipment busy on average six days per week for the next 24+ months. This business segment will be adding cash flow immediately and those numbers will be reflected in the financials. Forecasts suggest the Company will get a full return on investment by the end of June.

- The Company's extension into the pre-payment of a drill rig with 16,000' capabilities is starting to bear fruit. DME receives a predetermined amount on a daily basis for every day it is utilized. The rig has been contracted on an extended basis for all times other than when the Company will be utilizing it.

- Management has decided to sell helium at spot price and not sign any long-term contracts. The recent deficit in the global helium market has resulted in strong demand and unprecedented helium prices. Desert Mountain Energy Corp. does not project any short-term solutions for the helium market and prices are expected to be at historically high levels for the foreseeable future.

mr.h

I hate F$U and ND

- Joined

- Jan 17, 2013

- Messages

- 9,849

Banks do better in a higher interest environment..And if you dont believe David, how about Jaime Dimon?

Jamie Dimon says 'brace yourself' for an economic hurricane caused by the Fed and Ukraine war

"You know, I said there's storm clouds but I'm going to change it … it's a hurricane," Dimon said Wednesday at a financial conference in New York.www.cnbc.com

- Joined

- Oct 2, 2017

- Messages

- 8,618

Took down another chunk of ADRLF today at $0.0214 a share. You have to get your broker to get their overseas desk to buy it for you so you get the liquid version, but that's their problem. Potential 3x-25x return.

Last edited:

Banks do better in a higher interest environment..

Yes, but not recessions, which both Rosenberg and Dimon are forecasting. Doesnt mean its going to happen, but something to take into account.

- Joined

- Nov 28, 2016

- Messages

- 8,734

Forgive me for my excitement.Just a matter of time boys.

DESERT MOUNTAIN ENERGY APPOINTS MARTA HODAN WASKO AS VICE PRESIDENT OF GEOLOGY, by @newswire

TSX.V: DMEU.S. OTC: DMEHFFrankfurt: QM01ceo.ca

VANCOUVER, BC, June 1, 2022 /CNW/ - DESERT MOUNTAIN ENERGY CORP. (the "Company") (TSXV: DME) (OTC: DMEHF) (Frankfurt: QM01) From the President of the Company

The Company is pleased to announce that it has added Marta Hodan Wasko as VP of Geology. Marta is a petroleum geologist with a focus on sedimentology and stratigraphy with multiple years of experience in exploration, development, reservoir characterization, and wastewater injection. She has multiple degrees from the Colorado School of Mines, coupled with her experiences, in both the private sector and state regulation. Marta also has experience in well planning, permitting and drilling for oil, gas, helium and wastewater while working in both the private sector and state regulation. Her most recent position was as the Program Administrator for the Arizona Oil and Gas Conservation Commission. She worked on state regulations for oil, gas, and helium development while gaining knowledge of the historic and current helium exploration and development, in addition to gaining experience working with federal, state, local and Indigenous jurisdictions.

"We are extremely pleased we were able to have Marta join our company," says Robert Rohlfing, CEO of Desert Mountain Energy Corp. "She has an outstanding track record within the industry and her overall knowledge of both geology and regulatory compliance aspects are a great fit for our continued growth."

GENERAL UPDATE

- Construction on the McCauley Helium Processing Facility continues and DME will be adding selected pictures of the assembly to the website as it approaches completion. The Company expects to drill the next wildcat in the early part of July after the rig is released from the project it is currently on. DME will announce the permits when they have been received.

- Desert Mountain Energy's trucking company has sufficient work committed to keeping the equipment busy on average six days per week for the next 24+ months. This business segment will be adding cash flow immediately and those numbers will be reflected in the financials. Forecasts suggest the Company will get a full return on investment by the end of June.

- The Company's extension into the pre-payment of a drill rig with 16,000' capabilities is starting to bear fruit. DME receives a predetermined amount on a daily basis for every day it is utilized. The rig has been contracted on an extended basis for all times other than when the Company will be utilizing it.

- Management has decided to sell helium at spot price and not sign any long-term contracts. The recent deficit in the global helium market has resulted in strong demand and unprecedented helium prices. Desert Mountain Energy Corp. does not project any short-term solutions for the helium market and prices are expected to be at historically high levels for the foreseeable future.

*First full offtake after optimization period is expected to $2500 per MCF (above all my prior estimates)

*Processing & handling cost is 18-20 MCF , royalties and taxes approximately 60 MCF. (yes you read that right 90+% margins)

*Eyeing additional properties in Kansas and Colorado

Napkin math update in the chart below, yellow flow rates are assumed not confirmed. That's 1 plant running @ 76% capacity producing 200m+ revenue with an operating and royalty/taxes cost of roughly 6.7m. Roughly 2.90 Earnings Per Share at our current share count

For fun if we extrapolated 5 wells/1 plant to their ultimate target of 65 wells in arizona we're looking at 2.75B in annual revenue, or 34$ earnings per share fully diluted.

This doesn't account for the hydrogen finds, argon, neon, or other rare earth gasses (HE3 would literally send us to the moon and back)

This also doesn't fully account for well 1 i've mentioned in the past but it's absolute behemoth. If it were even possible to extract it at full pressure it'd be worth 1.5b alone in annual revenue

For the negatives

* Assume we'll be 2-4 weeks late on processing plant completion (end of july)

* I'm assuming optimization will take longer than the 90 days they expect just because.

* An accelerated timeline for procuring additional processing capacity has not been formally announced.

* Nasdaq listing timeline isn't clear. Personally i'm assuming q4 2023 or later.

* The market hasn't recognized helium yet, and they likely won't till it's on the balance sheet and their jaws are on the floor.

Ask me anything, Do your DD, please poke any holes in my DD you see.

Russia restricts exports of Helium & Neon sourced by Western & E Asian microchip firms

The deliveries will now be carried out only by the decision of the Government of the Russian Federation, according to a resolution of the Cabinet of Ministers.

Helium and rare gas concerns are real: 2022 CMC Conference recap

On April 28-29, TECHCET, the electronic materials advisory firm providing business and technology information, held its highly successful and well-attended 2022 7th Annual Critical Materials Council (CMC) Conference in Chandler, AZ.

that is awesome news...Forgive me for my excitement.

*First full offtake after optimization period is expected to $2500 per MCF (above all my prior estimates)

*Processing & handling cost is 18-20 MCF , royalties and taxes approximately 60 MCF. (yes you read that right 90+% margins)

*Eyeing additional properties in Kansas and Colorado

Napkin math update in the chart below, yellow flow rates are assumed not confirmed. That's 1 plant running @ 76% capacity producing 200m+ revenue with an operating and royalty/taxes cost of roughly 6.7m. Roughly 2.90 Earnings Per Share at our current share count

View attachment 188179

For fun if we extrapolated 5 wells/1 plant to their ultimate target of 65 wells in arizona we're looking at 2.75B in annual revenue, or 34$ earnings per share fully diluted.

This doesn't account for the hydrogen finds, argon, neon, or other rare earth gasses (HE3 would literally send us to the moon and back)

This also doesn't fully account for well 1 i've mentioned in the past but it's absolute behemoth. If it were even possible to extract it at full pressure it'd be worth 1.5b alone in annual revenue

View attachment 188180

For the negatives

* Assume we'll be 2-4 weeks late on processing plant completion (end of july)

* I'm assuming optimization will take longer than the 90 days they expect just because.

* An accelerated timeline for procuring additional processing capacity has not been formally announced.

* Nasdaq listing timeline isn't clear. Personally i'm assuming q4 2023 or later.

* The market hasn't recognized helium yet, and they likely won't till it's on the balance sheet and their jaws are on the floor.

Ask me anything, Do your DD, please poke any holes in my DD you see.

Russia restricts exports of Helium & Neon sourced by Western & E Asian microchip firms

The deliveries will now be carried out only by the decision of the Government of the Russian Federation, according to a resolution of the Cabinet of Ministers.economictimes.indiatimes.com

Helium and rare gas concerns are real: 2022 CMC Conference recap

On April 28-29, TECHCET, the electronic materials advisory firm providing business and technology information, held its highly successful and well-attended 2022 7th Annual Critical Materials Council (CMC) Conference in Chandler, AZ.www.gasworld.com

I thought the Nasdaq listing was going to be Q4 2022?

- Joined

- Nov 28, 2016

- Messages

- 8,734

I remember the President bringing it up a couple months back but i don't recall exactly what his words were. That q4 2023 was my speculation since we haven't heard much recently on it and quite honestly i think the company would be better off having a few full quarters of revenue and replenishing the treasury before taking center stage in a power position instead of with their hands out.that is awesome news...

I thought the Nasdaq listing was going to be Q4 2022?

Advertisement

@Caneinator knows about MULN...What do you all make of MULN? The tech is promising and price is right. I'm not a market guru.

Mikeiavelli

F the gaytors

- Joined

- Jan 24, 2018

- Messages

- 5,354

I am heavily invested in MULN. It is certainly a speculative play, and I believe the current price is partially the responsibility of MM and dark pool action.What do you all make of MULN? The tech is promising and price is right. I'm not a market guru.

With that out of the way, the battery tech, if it is as they say it is, is extremely promising. CEO stated yesterday that the battery BIC tested this month was a two year old battery and it actually increased output readings from last year.

Looking at a solid state polymer battery with range of 600 miles plus on a 20 minute charge. That's a game changer. No reliance on rare metals, much safer (can be heated, can be submerged in salt water and still operate), and has application beyond cars. He said yesterday they will look to license the tech and apply it to everything from lawnmowers to cell phones.

The key will be the ability to scale it to a vehicle pack level, and they have admitted it will take a few years to master that. But, they have hired this year some great minds with exceptional automotive backgrounds.

CEO is set to do another interview at 11am tomorrow with Benzinga. I'm looking forward to seeing what he hopefully has to add.

Company is due to have media event this month to reveal what F500 company is ordering vans from them which will be their revenue flow until the FIVE comes on market in 2024.

They will have a test drive tour with the FIVE starting in Oct. Next March they will have their FIVE RS available for ride alongs with a Formula E driver. That version has what they say is 1100hp and is capable of 0-60 in 1.9 seconds.

The big thing though is the battery tech. If it is what they say it is, and they can get it scaled relatively quickly, the battery makes it a multi billion market cap IMO.

There has been a bit of dilution lately, so it makes sense to have a lower share price. The market cap now is still in the 300 to 400 million range which IMO is low. But again, this right now is certainly a speculative play.

Mikeiavelli

F the gaytors

- Joined

- Jan 24, 2018

- Messages

- 5,354

Highlights from today's interview of the Mullen CEO

1)Pilot program vans were delivered to F500 company on May 12 and the company has positive feedback. Major order of vans to be announced in June.

2) 2 "major" OEM's have been in contact with MULN to start discussions on licensing the battery tech

3) Development of vehicle scaled packs for the Solid State Polymer Battery have been underway

4) Battery testing has shown scaled ability to produce more than 600 miles on a single charge.

1)Pilot program vans were delivered to F500 company on May 12 and the company has positive feedback. Major order of vans to be announced in June.

2) 2 "major" OEM's have been in contact with MULN to start discussions on licensing the battery tech

3) Development of vehicle scaled packs for the Solid State Polymer Battery have been underway

4) Battery testing has shown scaled ability to produce more than 600 miles on a single charge.

They all need lithium..

And nickel.

Advertisement

390,000 jobs added…3.6% unemployment…wage growth up….futures down…for now

Remember, we are in a "good news is bad for the market" phase, because the fear is inflation/stagflation. So you actually want the economic news to be bad, other than the inflation number.

Highlights from today's interview of the Mullen CEO

1)Pilot program vans were delivered to F500 company on May 12 and the company has positive feedback. Major order of vans to be announced in June.

2) 2 "major" OEM's have been in contact with MULN to start discussions on licensing the battery tech

3) Development of vehicle scaled packs for the Solid State Polymer Battery have been underway

4) Battery testing has shown scaled ability to produce more than 600 miles on a single charge.

I know nothing about the company, but they should do a reverse split.

Mikeiavelli

F the gaytors

- Joined

- Jan 24, 2018

- Messages

- 5,354

Mullen is getting added to the R3000 this month for the year. I know that the R3000 covers about 97% of equities in the US, so is that actually a big deal or not?

I see it as a message that the company is not a scam like many (eh hem Hindenburg) have said in order to manipulate and short it into oblivion.

@Cryptical Envelopment What say you sir?

I see it as a message that the company is not a scam like many (eh hem Hindenburg) have said in order to manipulate and short it into oblivion.

@Cryptical Envelopment What say you sir?