- Joined

- Jan 15, 2012

- Messages

- 5,949

Haven’t checked. Currently selling my AMC at a loss!! I got suckered.GME stock down 20 ish percent and the puts are all down as well. Market is really discombobulated with this stock

Haven’t checked. Currently selling my AMC at a loss!! I got suckered.GME stock down 20 ish percent and the puts are all down as well. Market is really discombobulated with this stock

I sold some of my calls today at $10.40 for 150% profit. Still have some though. As @SweetAndSour mentioned above my GME puts were down lol.Haven’t checked. Currently selling my AMC at a loss!! I got suckered.

I follow this kid.. Pretty smart... All you technicals.... any opinions on this video? Tech starts at 3:30

I follow this kid.. Pretty smart... All you technicals.... any opinions on this video? Tech starts at 3:30

I had some EXPR puts i bought friday and they were down also (stock down 17 percent) . Any idea what could account for that? I'm stumped, generally when you buy a put and the underlying stock falls 20 percent its a good day, but not today! Maybe just too much interest in the puts?I sold some of my calls today at $10.40 for 150% profit. Still have some though. As @SweetAndSour mentioned above my GME puts were down lol.

I have heard that. They have been SUPER paranoid about that happening. It’s also one thing to take on a hedge fund or two. Is another thing to take on JP Morgan.@Bird4um @wspcane The current WSB scuttlebutt for SLV is the GME bagholders appear to losing confidence in GME and are attacking everyone who distracts from the GME play. Most original SLV threads have been deleted and they're saying it was coordinated media/wall street attack to push silver.

This has been hilarious to watch unfold. I was long silver before WSB and think the next reversal in the DXY will push us to my next technical target of 36$ regardless of what WSB does. And let's not forget, physical nearly sold out in just a weekend of retail interest. They physical you can find is selling for 20% or better premium. This is before projected increases in commercial use for EV's, renewables, etc.

I had some EXPR puts i bought friday and they were down also (stock down 17 percent) . Any idea what could account for that? I'm stumped, generally when you buy a put and the underlying stock falls 20 percent its a good day, but not today! Maybe just too much interest in the puts?

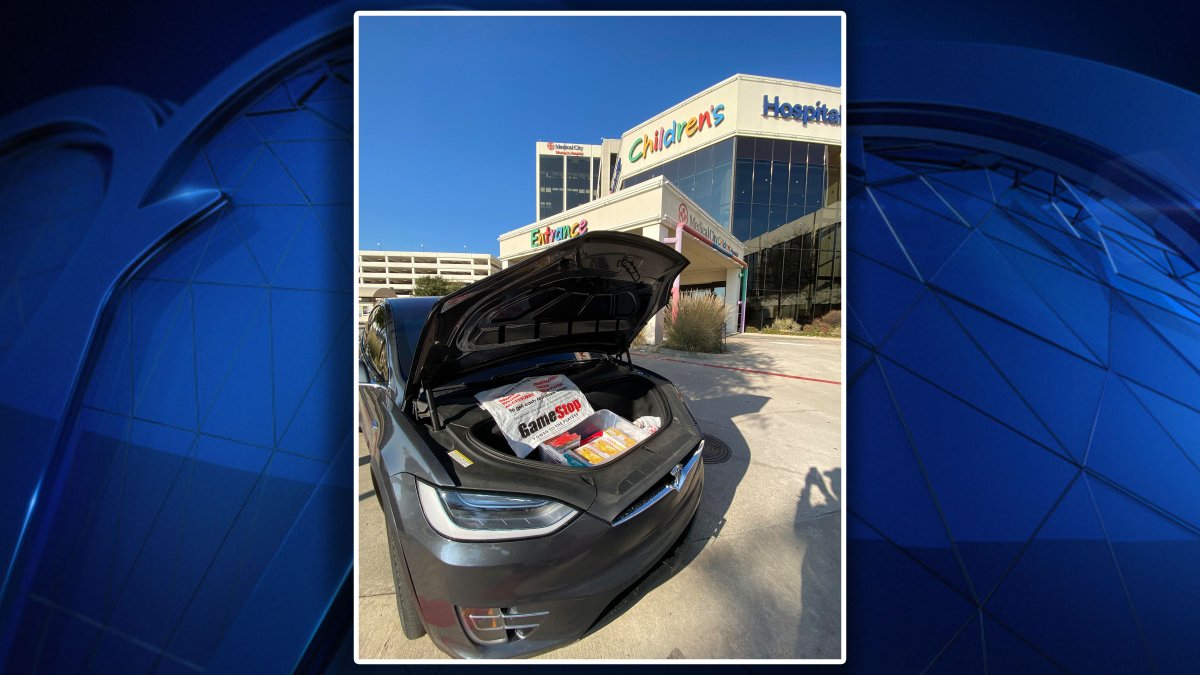

www.nbcdfw.com

www.nbcdfw.com

Reddit subs pumping doge again tomorrow thru Friday. Probably some quick cash to make there.

But not today? Why does it "start" tomorrow?

But not today? Why does it "start" tomorrow?

It's begun. Up 8k over night