What's up with the lawsuit?SRNE When it goes into phase one texting it should lock in above 9. When it goes to phase two I’m thinking 20/24 and three should bring a selling number if 75 for me. Take a shot. It’s the highest number of success rate, at 80%, of anything I’ve read about.

forums

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Off-Topic Stock Market & Crypto Discussion

- Thread starter Bird4um

- Start date

More options

Who Replied?

Advertisement

Boarcane

All ACC

- Joined

- Jul 10, 2012

- Messages

- 7,615

Nothing just an attorney seeing what he can get. America? The price is now above what it was under their claimWhat's up with the lawsuit?

Thought so. Tha ks for SRNE.Nothing just an attorney seeing what he can get. America? The price is now above what it was under their claim

Great call on SRNE. Bought and looking to buy more!SRNE When it goes into phase one texting it should lock in above 9. When it goes to phase two I’m thinking 20/24 and three should bring a selling number if 75 for me. Take a shot. It’s the highest number of success rate, at 80%, of anything I’ve read about.

- Joined

- Oct 2, 2017

- Messages

- 8,620

Please be really careful and do your due diligence with SRNE. I've traded it short term before, but would never hold it. Results talk, and the stock has had a run so can't argue there, and the insiders there keep pumping that its a moon-shot, but management is very, very sketchy. Ji has a terrible, terrible rep for playing games with stock options via subsidiaries at shareholder expense. Check under the hood with people in the industry. AGP (pretty shady themselves) did their ATM offering. Lot of BS and risk here. Too much risk to speculate IMO.

Just a taste:

www.prnewswire.com

www.prnewswire.com

That said, may it run to $200, and may all your cups always be full.

Just a taste:

Wildcat Capital Issues Letter to Board of Sorrento Therapeutics

/PRNewswire/ -- Wildcat Capital Management LLC ("Wildcat"), whose clients hold an ownership stake of 6.5% of the common stock of Sorrento Therapeutics, Inc....

That said, may it run to $200, and may all your cups always be full.

Advertisement

Appreciate your advice. This is only the play money part of my portfolio. The money where I'm a quasi day trader. That said, I do take even this part of my portfolio seriously.Please be really careful and do your due diligence with SRNE. I've traded it short term before, but would never hold it. Results talk, and the stock has had a run so can't argue there, and the insiders there keep pumping that its a moon-shot, but management is very, very sketchy. Ji has a terrible, terrible rep for playing games with stock options via subsidiaries at shareholder expense. Check under the hood with people in the industry. AGP (pretty shady themselves) did their ATM offering. Lot of BS and risk here. Too much risk to speculate IMO.

Just a taste:

Wildcat Capital Issues Letter to Board of Sorrento Therapeutics

/PRNewswire/ -- Wildcat Capital Management LLC ("Wildcat"), whose clients hold an ownership stake of 6.5% of the common stock of Sorrento Therapeutics, Inc....www.prnewswire.com

That said, may it run to $200, and may all your cups always be full.

- Joined

- Oct 2, 2017

- Messages

- 8,620

Appreciate your advice. This is only the play money part of my portfolio. The money where I'm a quasi day trader. That said, I do take even this part of my portfolio seriously.

Just something to look at. I fučk with some of the crazy in my play account too. ****, I will make a call right now at the current price. Buy LPTX before the close at $1.93 - I just did. Hold me to this, just like the VFF options.

Empirical Cane

We are what we repeatedly do.

- Joined

- Sep 3, 2018

- Messages

- 33,552

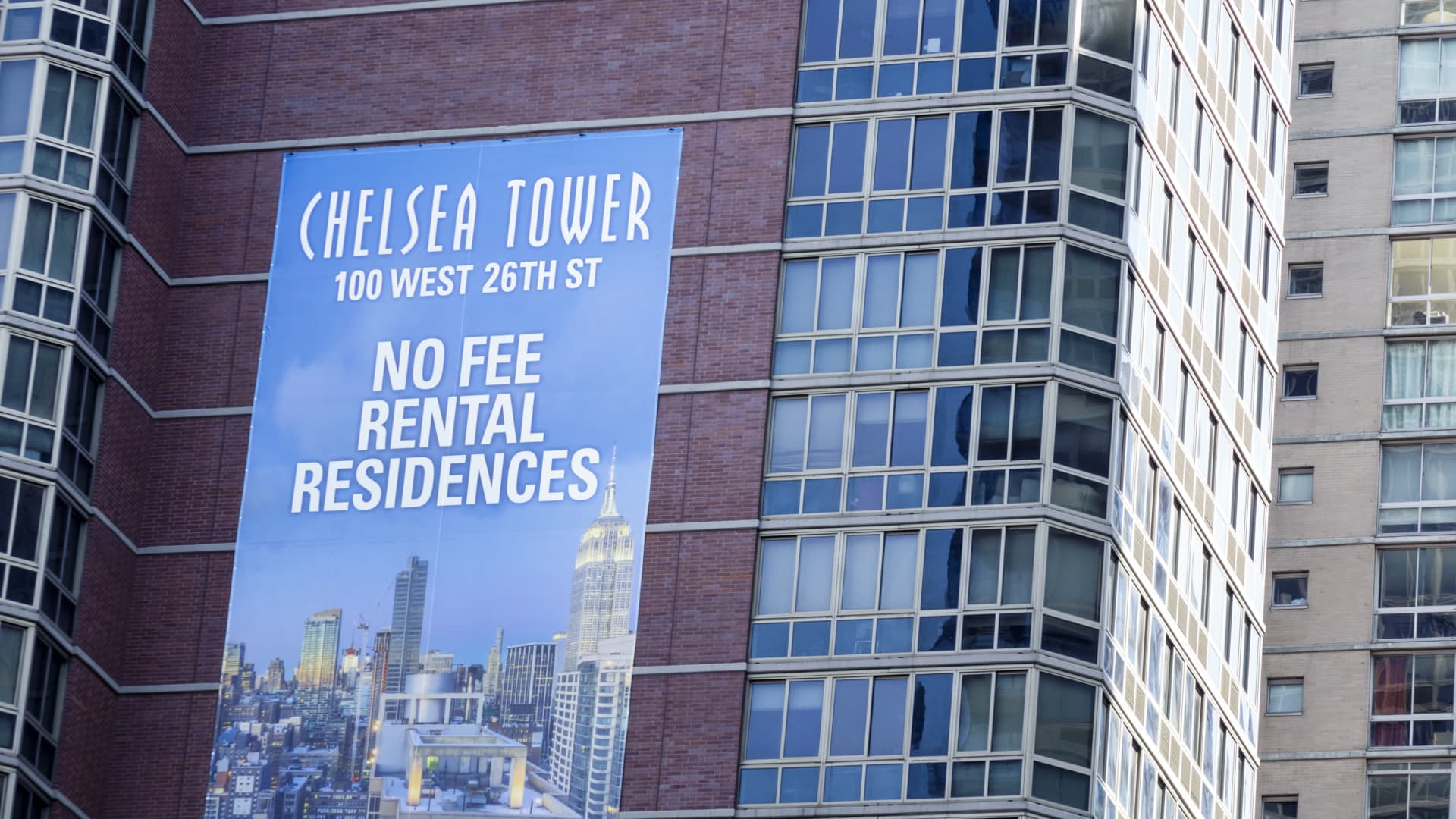

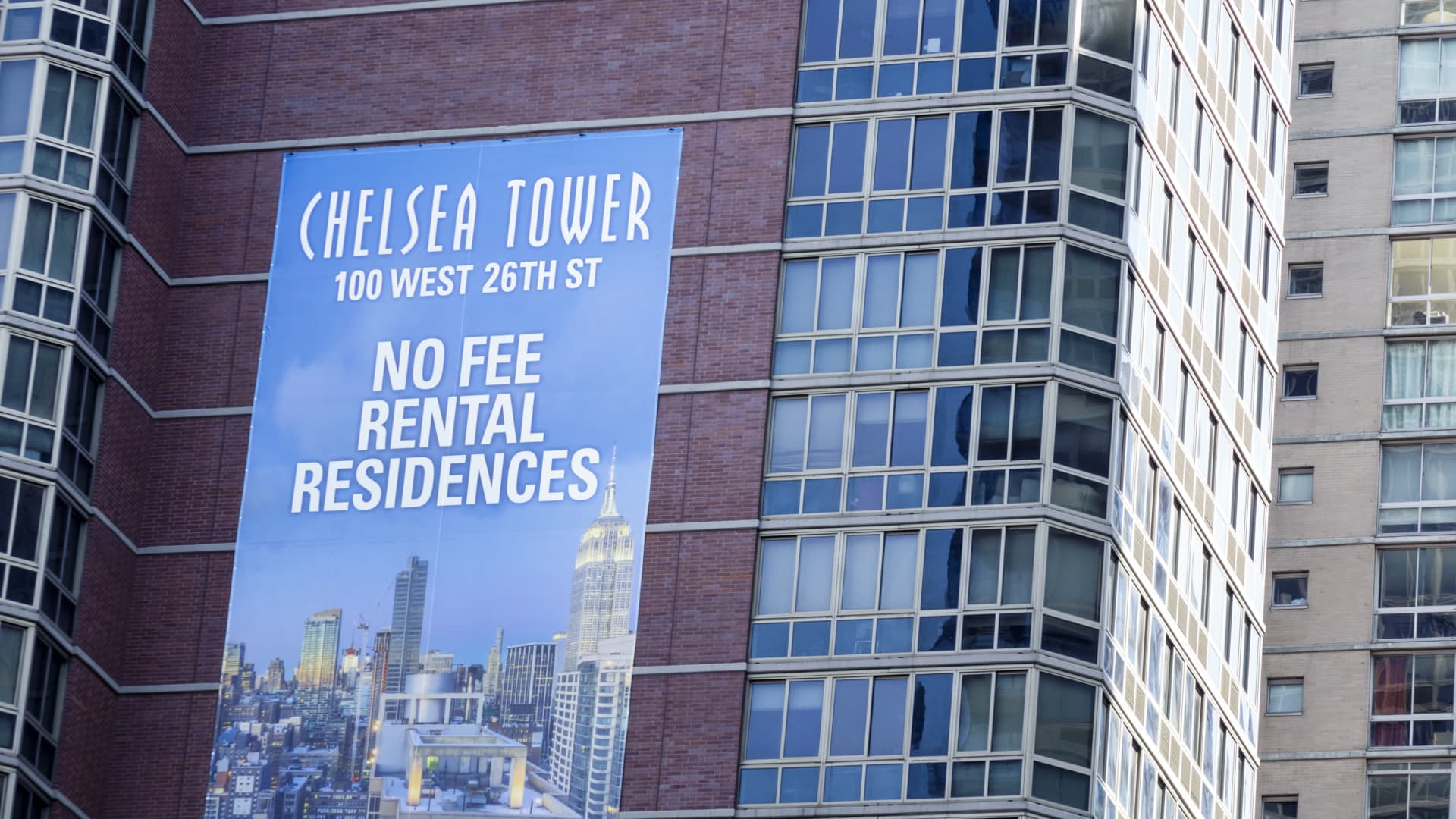

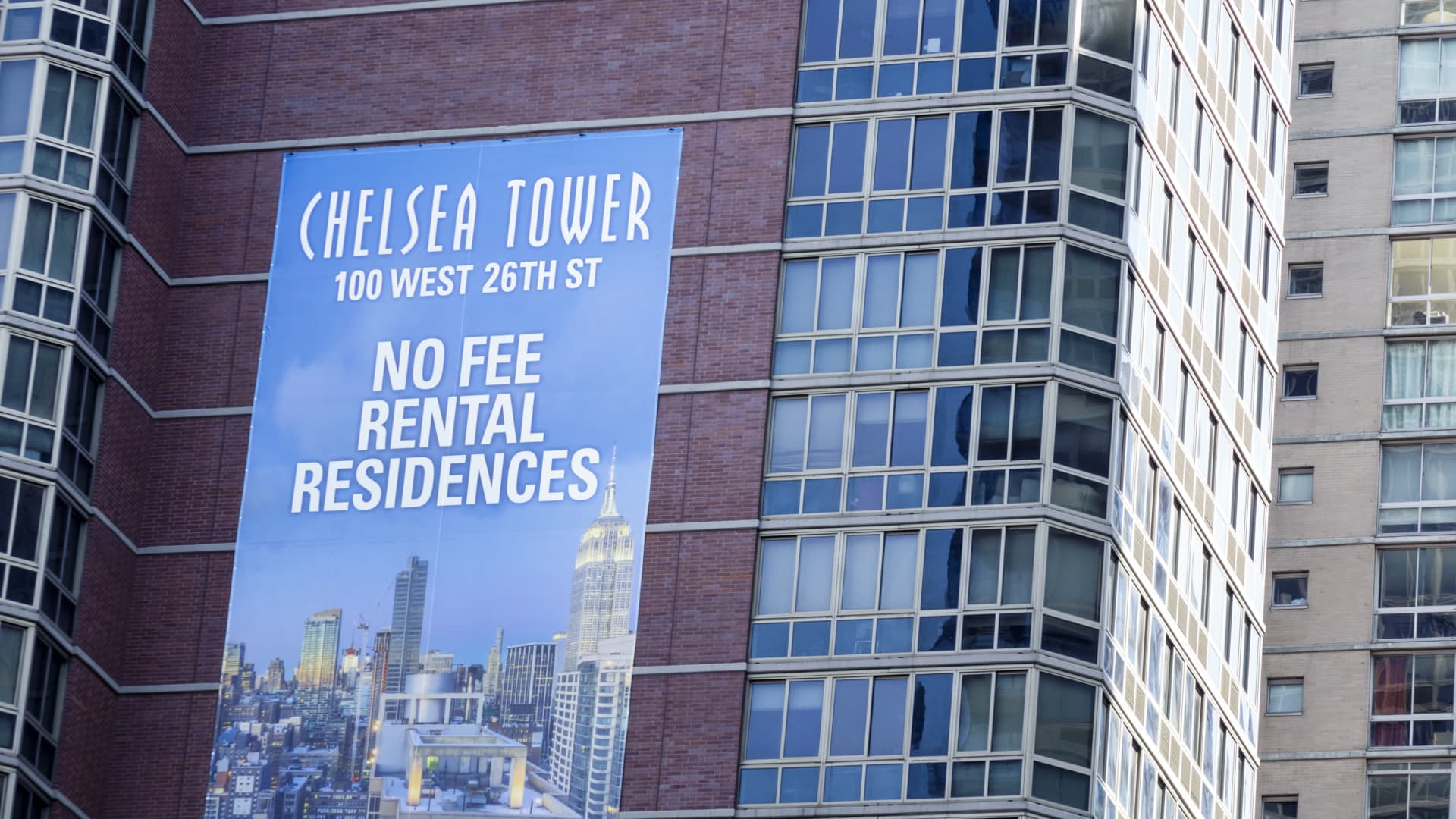

Empty Manhattan apartments reach record levels, landlords slash rent

The number of apartments listed for rent in Manhattan reached record levels in June, as brokers remained unable to host showings and more renters left the city, according to a new report.

If Gothamites are truly fleeing NYC, this will have a profound 3-5-10 year affect on several cities. I suspect a bump would come to the Charlotte-Raleigh corridor and deepening the already bitter divide in NC.

Anybody want to hold paper on big city rentals?

Buying opportunity or suicide? Somebody is going to make Brink's truck on this trend.

Right on! Unfortunately, you have to project out worst case scenarios and be prepared to act.

Empty Manhattan apartments reach record levels, landlords slash rent

The number of apartments listed for rent in Manhattan reached record levels in June, as brokers remained unable to host showings and more renters left the city, according to a new report.www.cnbc.com

If Gothamites are truly fleeing NYC, this will have a profound 3-5-10 year affect on several cities. I suspect a bump would come to the Charlotte-Raleigh corridor and deepening the already bitter divide in NC.

Anybody want to hold paper on big city rentals?

Buying opportunity or suicide? Somebody is going to make Brink's truck on this trend.

Advertisement

Okay, i'll follow. Mentioned zyxi before on here, bought yesterday and sold today for a 14% gain and I know exactly what they do but could care a less.Just something to look at. I fučk with some of the crazy in my play account too. ****, I will make a call right now at the current price. Buy LPTX before the close at $1.93 - I just did. Hold me to this, just like the VFF options.

- Joined

- Oct 2, 2017

- Messages

- 8,620

Empty Manhattan apartments reach record levels, landlords slash rent

The number of apartments listed for rent in Manhattan reached record levels in June, as brokers remained unable to host showings and more renters left the city, according to a new report.www.cnbc.com

If Gothamites are truly fleeing NYC, this will have a profound 3-5-10 year affect on several cities. I suspect a bump would come to the Charlotte-Raleigh corridor and deepening the already bitter divide in NC.

Anybody want to hold paper on big city rentals?

Buying opportunity or suicide? Somebody is going to make Brink's truck on this trend.

Buying opp 100% IMO. But its not at bottom yet. When a vaccine is truly within eye view the VC and foreign money is going to flow in hard. NYC will always be NYC. It has always survived and always will. This is a temporary situation.

- Joined

- Sep 25, 2014

- Messages

- 106

Can someone explain to a knuckle dagger the S&P 500 and NASDAQ. I recently just took my first venture into the stock market... bought 6 shares of Amazon at 2600 and cant complain, but I'd like to diversify. I'm thinking Disney, Tesla and Microsoft but dont know what else. Should I just buy 3 more shares of amazon? I have about 10k disposable to invest

Boarcane

All ACC

- Joined

- Jul 10, 2012

- Messages

- 7,615

Great call on SRNE. Bought and looking to buy more!

Can This Coronavirus Stock Soar 230%? 5-Star Analyst Thinks So

Diversification is a tried-and-true strategy when investing in stocks. Drug maker Sorrento Therapeutics (SRNE) is applying the same thought process in its battle against the coronavirus. The multi-pronged approach involving a search for antiviral therapies, a vaccine and the production of...

www.google.com

Advertisement

Boarcane

All ACC

- Joined

- Jul 10, 2012

- Messages

- 7,615

Diversity is overrated. I’ll never own more than 8 to 10 individual equity’s at once. ETF’s are good if you’re looking to leverage a specific group of stocks. I’d be comfortable buying Amazon, Tesla and Microsoft here. Two great companies and balance sheets. Tesla because they’ll be added to the S&P after they post this quarter. The market should pull back after the S&P hits 3400ish. I’d sell at that point and buy short ETF’s and/or gold. That’s me in the next 30 daysCan someone explain to a knuckle dagger the S&P 500 and NASDAQ. I recently just took my first venture into the stock market... bought 6 shares of Amazon at 2600 and cant complain, but I'd like to diversify. I'm thinking Disney, Tesla and Microsoft but dont know what else. Should I just buy 3 more shares of amazon? I have about 10k disposable to invest

- Joined

- Oct 2, 2017

- Messages

- 8,620

Can someone explain to a knuckle dagger the S&P 500 and NASDAQ. I recently just took my first venture into the stock market... bought 6 shares of Amazon at 2600 and cant complain, but I'd like to diversify. I'm thinking Disney, Tesla and Microsoft but dont know what else. Should I just buy 3 more shares of amazon? I have about 10k disposable to invest

If you are going to go FAANG or big cap/brand name I like Netflix more than the others you mentioned, AT THESE PRICES. Though Disney and MSFT wouldn't be bad buys either, for long term plays. Tesla is a little rich right now IMO.

I am always wrong on AMZN, I've said don't buy it a hundred times and I've been wrong 100 times, so I disqualify myself from commenting there

- Joined

- Oct 2, 2017

- Messages

- 8,620

Diversity is overrated. I’ll never own more than 8 to 10 individual equity’s at once. ETF’s are good if you’re looking to leverage a specific group of stocks. I’d be comfortable buying Amazon, Tesla and Microsoft here. Two great companies and balance sheets. Tesla because they’ll be added to the S&P after they post this quarter. The market should pull back after the S&P hits 3400ish. I’d sell at that point and buy short ETF’s and/or gold. That’s me in the next 30 days

Bingo. Why invest money in your 30th best idea when you can put money in your 1 to 10th best ideas? Not including your flyer portfolio of course.

Advertisement

tcgrad1014

All-ACC

- Joined

- Nov 5, 2011

- Messages

- 13,524

Can someone explain to a knuckle dagger the S&P 500 and NASDAQ. I recently just took my first venture into the stock market... bought 6 shares of Amazon at 2600 and cant complain, but I'd like to diversify. I'm thinking Disney, Tesla and Microsoft but dont know what else. Should I just buy 3 more shares of amazon? I have about 10k disposable to invest

VTI

jkaz1

Senior

- Joined

- Feb 1, 2012

- Messages

- 4,667

AMZN is certainly a fine company to own shares in - congrats on the invt.

I'd recommend diversifying into other companies.

It reduces your overall risk and also gives you a better opportunity to find a long-term huge winner.

Also, if you're interested in getting more involved in the stock market, by owning more companies you get to learn more about more companies and industries as you go along.

Don't rush to invest - take your time to find a company that you're comfortable investing in.

NASDAQ is a stock exchange - like the NYSE and lots of other exchanges in the States and around the world.

When you see the daily % return on the NASDAQ it's just a composite of all companies on the exchange - weighted by market capitalization- for how they did on a given day.

The largest companies will have a far larger impact on the performance of the NASDAQ due to their size (market cap).

The S&P 500 is a stock index that measures the performance of the 500 largest publicly-traded companies in the US.

The companies in the index change over time depending on who's growing and who's shrinking.

I'd recommend diversifying into other companies.

It reduces your overall risk and also gives you a better opportunity to find a long-term huge winner.

Also, if you're interested in getting more involved in the stock market, by owning more companies you get to learn more about more companies and industries as you go along.

Don't rush to invest - take your time to find a company that you're comfortable investing in.

NASDAQ is a stock exchange - like the NYSE and lots of other exchanges in the States and around the world.

When you see the daily % return on the NASDAQ it's just a composite of all companies on the exchange - weighted by market capitalization- for how they did on a given day.

The largest companies will have a far larger impact on the performance of the NASDAQ due to their size (market cap).

The S&P 500 is a stock index that measures the performance of the 500 largest publicly-traded companies in the US.

The companies in the index change over time depending on who's growing and who's shrinking.

Can someone explain to a knuckle dagger the S&P 500 and NASDAQ. I recently just took my first venture into the stock market... bought 6 shares of Amazon at 2600 and cant complain, but I'd like to diversify. I'm thinking Disney, Tesla and Microsoft but dont know what else. Should I just buy 3 more shares of amazon? I have about 10k disposable to invest

- Joined

- Jan 15, 2012

- Messages

- 4,416

Nexcf

June 1, 2020 : CEO Evan Gappelberg purchased 100,000 shares. It was reported that on 5/5/2020 he purchased 929,885 common shares of NexTech common stock, this is his fourth buy for the year 2020. He is from TakeTwo and GTA

June 1, 2020 : CEO Evan Gappelberg purchased 100,000 shares. It was reported that on 5/5/2020 he purchased 929,885 common shares of NexTech common stock, this is his fourth buy for the year 2020. He is from TakeTwo and GTA

Last edited:

Can someone explain to a knuckle dagger the S&P 500 and NASDAQ. I recently just took my first venture into the stock market... bought 6 shares of Amazon at 2600 and cant complain, but I'd like to diversify. I'm thinking Disney, Tesla and Microsoft but dont know what else. Should I just buy 3 more shares of amazon? I have about 10k disposable to invest

Crypto

Advertisement